The U.S. Treasury Division has formally despatched the White Home its proposal to start out amassing information on marijuana companies from banks—alongside industries it already tracks like liquor shops, comfort shops, casinos and automotive sellers—as a part of its ongoing efforts to fight cash laundering actions.

In a discover printed within the Federal Register late final week, Treasury’s Workplace of the Comptroller of the Foreign money (OCC) stated that it has accomplished preliminary procedural steps on the plan, and it will likely be accepting a ultimate spherical of public feedback because the White Home Workplace of Administration and Funds (OMB) conducts a evaluation.

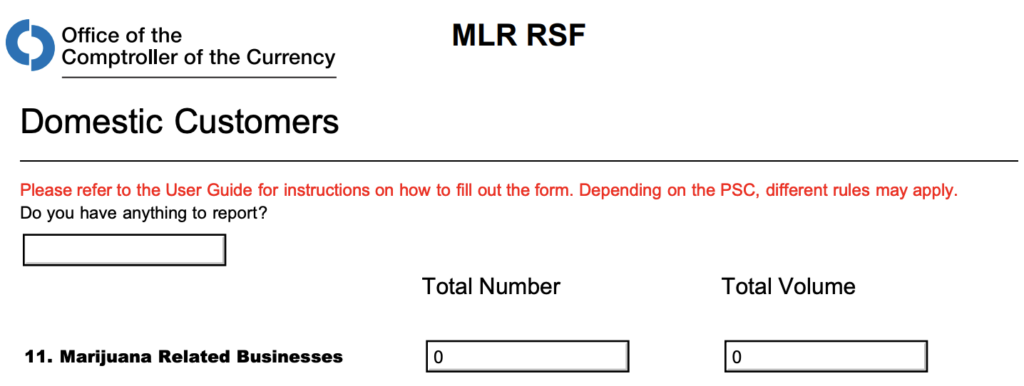

OCC first introduced the proposal in June, saying it plans to trace marijuana companies as a part of an annual Danger Abstract Kind (RSF) that must be filed by monetary establishments. It’s seen as one other signal of the federal authorities’s recognition of the state-legal hashish market, at the same time as marijuana stays a federally managed substance.

“The RSF collects information about completely different merchandise, providers, clients, and geographies (PSCs),” the newest discover says. To that finish, Treasury stated it needs so as to add “marijuana-related companies” to the record of markets it displays, in addition to 5 different new classes equivalent to crypto belongings and ATM operators.

By way of OCC.

The division stated that its Cash Laundering Danger System “enhances the flexibility of examiners and financial institution administration to determine and consider” dangers which are “related to banks’ merchandise, providers, clients, and areas.”

With the emergence of recent services and products, “banks’ analysis of cash laundering and terrorist financing dangers ought to evolve as nicely.” Subsequently, by making these adjustments to its information assortment course of, the company stated it will likely be higher in a position to “determine these establishments, and areas inside establishments, which will pose heightened danger and allocate examination sources accordingly.”

A ultimate public remark interval on the proposed adjustments is open by way of October 11.

In August, the Nationwide Hashish Trade Affiliation (NCIA) submitted a remark following the proposal’s preliminary announcement. It stated that the group is “happy to see the OCC acknowledge the impression marijuana-related companies are having on our monetary system.”

NCIA stated it helps the division’s “endeavor to enhance information assortment on this comparatively new sector, improve transparency into the business for regulators, and assist scale back among the administrative burden on banks in order that extra establishments will select to service the business.”

“Challenges ensuing from the dearth of banking aren’t restricted to hashish companies, but in addition impression entities that select to interact with and repair them; together with monetary establishments themselves. Consequently, the MLR danger evaluation is a vital device for the OCC’s Financial institution Secrecy Act/Anti-Cash Laundering and OFAC supervision actions as a result of it permits the company to higher determine these establishments, and areas inside establishments, which will pose heightened danger and allocate examination sources accordingly.”

It’s not instantly clear how the knowledge collected on the RSF—which if authorised will ask monetary providers suppliers to report each the variety of their marijuana enterprise accounts and their total quantity—is analyzed or disseminated by OCC after being submitted by banks, however the brand new discover says the info permits the company to “higher determine these establishments, and areas inside establishments, which will pose heightened danger and allocate examination sources accordingly.”

Info on the variety of monetary establishments that work with cannabis-related companies is already reported by way of Suspicious Exercise Reviews (SARs) that banks and credit score unions are required to submit beneath current steerage, and Treasury’s Monetary Crimes Enforcement Community (FinCEN) publicly releases that information on a quarterly foundation.

The variety of banks that report working with marijuana companies ticked up once more close to the top of 2021—with 755 banks and credit score unions having submitted the related reported as of September 30, 2021—in line with FinCEN’s newest replace in March.

As Congress works to advance laws to finish federal hashish prohibition and reform banking insurance policies associated to the marijuana business, the federal government has tacitly acknowledged and normalized its existence although hashish stays a Schedule I drug beneath the Managed Substances Act.

For instance, the U.S. Census Bureau introduced final 12 months that it could start amassing and compiling information on income that states generate from authorized marijuana.

The transfer—so as to add a hashish query to annual studies that states submit—builds upon a separate discover the federal company posted final 12 months that defined it could be incorporating state-level hashish tax information in its quarterly studies.

In the meantime, in 2021 the U.S. Financial Classification Coverage Committee—which is comprised of the White Home Workplace of Administration and Funds, the Census Bureau, the Bureau of Financial Evaluation and the Bureau of Labor Statistics—really useful a coverage change to incorporate hashish companies as an official designation within the the North American Trade Classification System (NAICS), which is used to categorize and compile employment and market information on industries throughout the U.S., Mexico and Canada.

Atlanta Lawmakers Talk about Psychedelics Decriminalization Decision

The submit Treasury Asks White Home To Approve Plan On Accumulating Marijuana Enterprise Banking Knowledge appeared first on Marijuana Second.